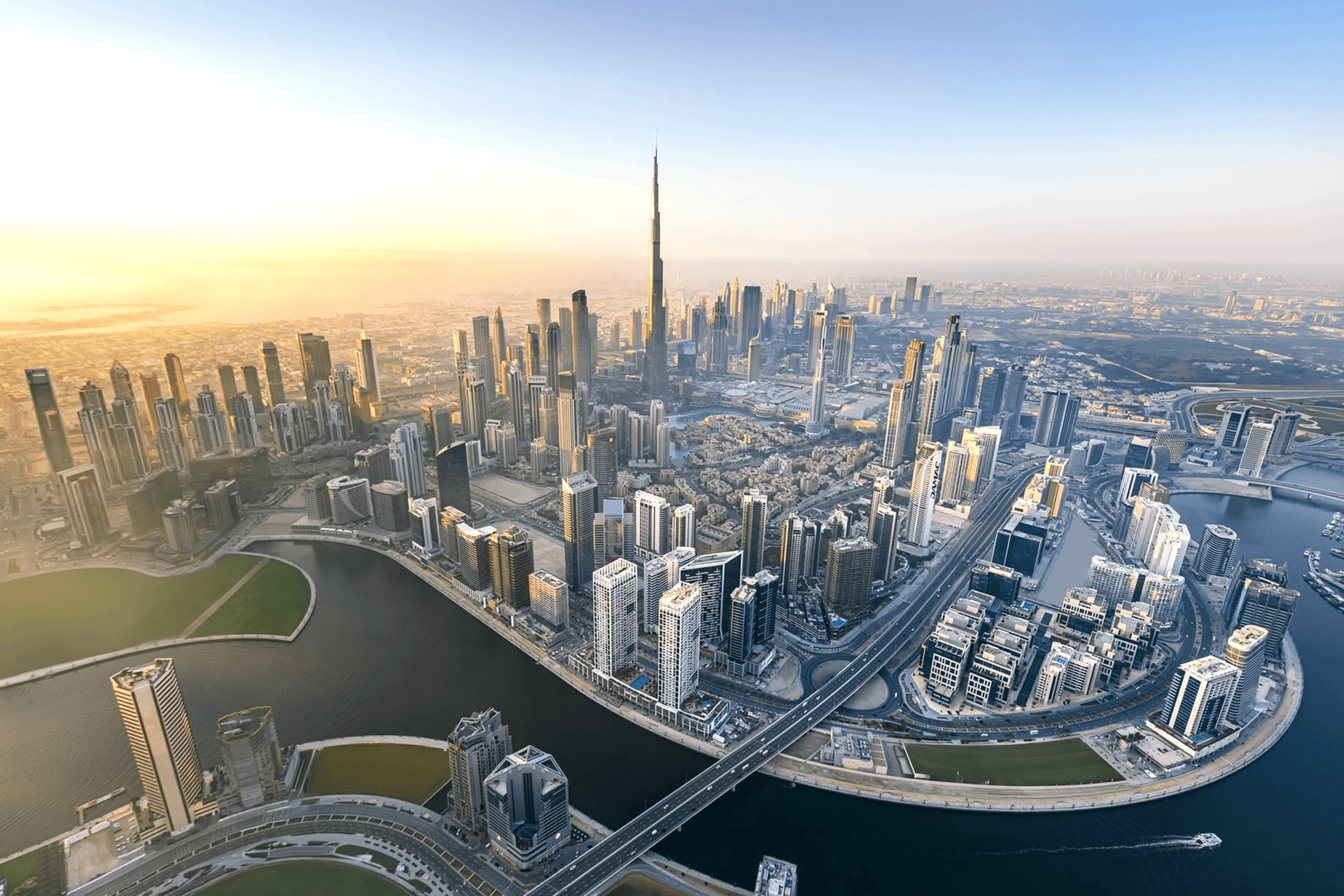

Dubai’s residential property market reached new heights in 2024, with 169,000 sales, marking a 42% increase from 2023, according to Cavendish Maxwell. Property prices saw 16.5% year-on-year growth, with an average price per square foot hitting AED 1,493 ($407). The market has now seen 47 consecutive months of price increases, though appreciation is gradually stabilizing at 1% monthly growth.

Mortgage activity hit a record 36,600 loans, up nearly 33% from 2023. The off-plan sector dominated, with sales four times higher than pre-pandemic levels. Developers like Emaar, Binghatti, and DAMAC led the market, with 145,000 new off-plan units launched—averaging 400 daily.

Top Locations for New Homes: Mohammed Bin Rashid City (5,300), Jumeirah Village Circle (4,800), Business Bay (2,800), Al Furjan (2,600).

Highest Apartment Price Increases: Barsha Heights (+33%), Dubai Silicon Oasis (+24%), Jumeirah Lakes Towers (+21%).

Biggest Villa Price Gains: Nad Al Sheba (+54%), Jumeirah Village Triangle (+33%), Dubai South (+29%).

Best Rental Yields: Dubai Investments Park (10.3%), International City (9.4%), Dubai Production City & Downtown Jebel Ali (8.6%).

Source: Economist.com

Average rental yields remained strong at 7.4% for apartments and 5.1% for villas/townhouses. Apartment rents surged the most in Dubai South (+30%), Al Furjan (+27%), and Dubai Production City (+24%). Villas saw the highest rental hikes in Palm Jumeirah (+52%), Al Furjan (+39%), and Dubai Investments Park (+38%).

Dubai’s real estate market is set for continued but sustainable growth in 2025, with 243,000 units in the pipeline by 2027. The largest upcoming supply will be in Jumeirah Village Circle (25,000), Business Bay (16,000), Azizi Venice (13,500), and DAMAC Lagoons (11,100).

With rising prices, increasing transaction volumes, and strong rental yields, Dubai remains a prime destination for investors seeking high returns.